Jhunjhunwala Family Exits Nazara Technologies Weeks Before Gaming Ban – A Timely Move That Saved ₹334 Crore

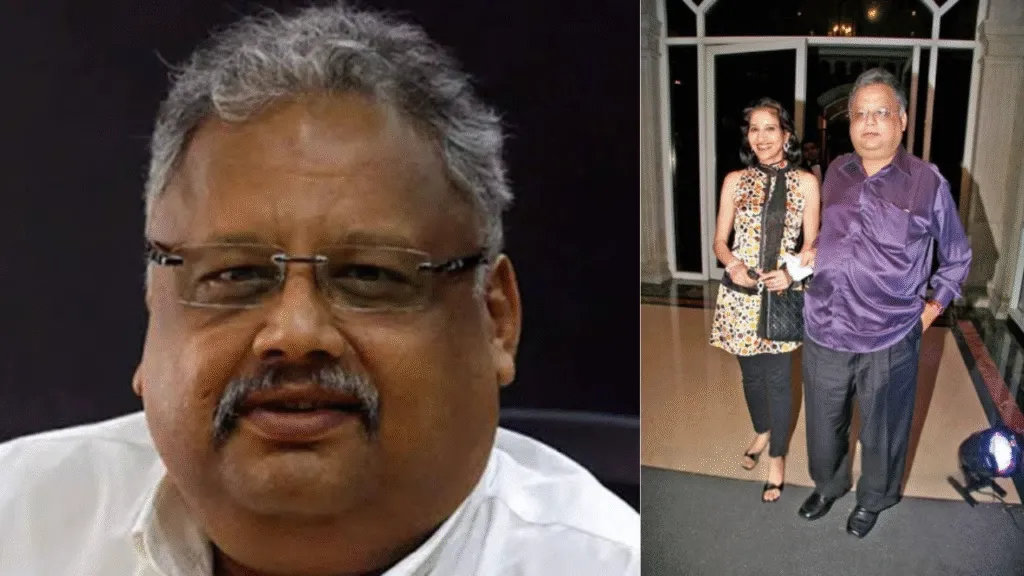

In a move that is now being described as one of the most well-timed investment exits of 2025, Rekha Jhunjhunwala, wife of late market veteran Rakesh Jhunjhunwala, sold her entire stake in gaming company Nazara Technologies just weeks before the Indian government announced a ban on real-money gambling games. The decision not only marked the family’s complete exit from the company but also saved her from heavy losses as the stock nosedived following the announcement of the new law.

How the Exit Happened

As of March 2025, Rekha Jhunjhunwala held about 7.06% stake in Nazara, which translated to nearly 6.18 million shares. On June 13, 2025, she offloaded her entire holding through bulk deals:

- 13 lakh shares on the BSE

- 14.23 lakh shares on the NSE

The total sale amounted to ₹334 crore, at an average price of around ₹1,225 per share. This marked the final exit of the Jhunjhunwala family from Nazara, a company that Rakesh Jhunjhunwala had backed early and held for years.

Market Reaction – Crash After the Ban

Soon after her exit, Nazara shares witnessed a brutal fall. The government passed the Promotion and Regulation of Online Gaming Bill, 2025, banning real-money gambling platforms and introducing tough penalties—up to three years in jail and fines as high as ₹1 crore.

Following the announcement:

- Nazara shares plunged nearly 17–19% within five trading sessions.

- The stock tanked as much as 23% in just two days, wiping out massive investor wealth.

By exiting when she did, Rekha Jhunjhunwala avoided potential losses worth ₹334 crore, making her move appear exceptionally calculated.

Other Big Investors Stayed Put

While the Jhunjhunwalas cashed out completely, other well-known investors chose to remain invested in Nazara.

- Madhusudan Kela, veteran investor, still holds 1.18% stake (10.96 lakh shares).

- Nikhil Kamath, co-founder of Zerodha, through Kamath Associates, continues to hold 1.62% stake (15.04 lakh shares).

These investors appear to be betting on Nazara’s broader portfolio in eSports, gamified learning, and casual gaming, despite the regulatory overhang on real-money gaming.

What the Company Said

Nazara Technologies, in a statement, clarified that it does not generate revenues directly from real-money gambling games. However, its minority stake in PokerBaazi (owned by Moonshine Technology) created concerns among investors.

The company highlighted:

- Its consolidated revenue streams come mainly from gamified learning platforms, eSports, and arcade gaming.

- Real-money gaming revenues from PokerBaazi are not consolidated in its books.

- Its long-term fundamentals remain strong despite regulatory noise.

Still, brokerages have turned cautious. ICICI Securities, for instance, downgraded the stock to “Reduce” and cut its target price to ₹1,100, citing uncertainty around future growth.

Social Media and Market Buzz

The timing of Rekha Jhunjhunwala’s exit has sparked massive debate in financial circles and on social media. While some called it an example of her astute investment sense and timing, others speculated whether insider knowledge influenced the decision.

Regardless of speculation, the fact remains that the sale shielded her from steep post-ban losses, further cementing the Jhunjhunwala family’s reputation for smart market moves.

Conclusion

Rekha Jhunjhunwala’s decision to completely offload her ₹334 crore stake in Nazara Technologies just before the government’s gaming crackdown has gone down as one of the smartest exits of the year.

- She locked in healthy gains and avoided a sharp post-ban collapse.

- Other marquee investors like Nikhil Kamath and Madhusudan Kela have chosen to stay invested, betting on Nazara’s non-gambling businesses.

- With the new online gaming bill reshaping the industry, Nazara’s future remains uncertain, though the company insists its core revenue model is unaffected.

In hindsight, this move underscores the importance of timing in stock markets—sometimes the difference between massive gains and painful losses comes down to getting out just a little earlier than the rest.

Also Read: How to Create a Study Schedule with AI: Smart Tools for Smarter Learning 2025.