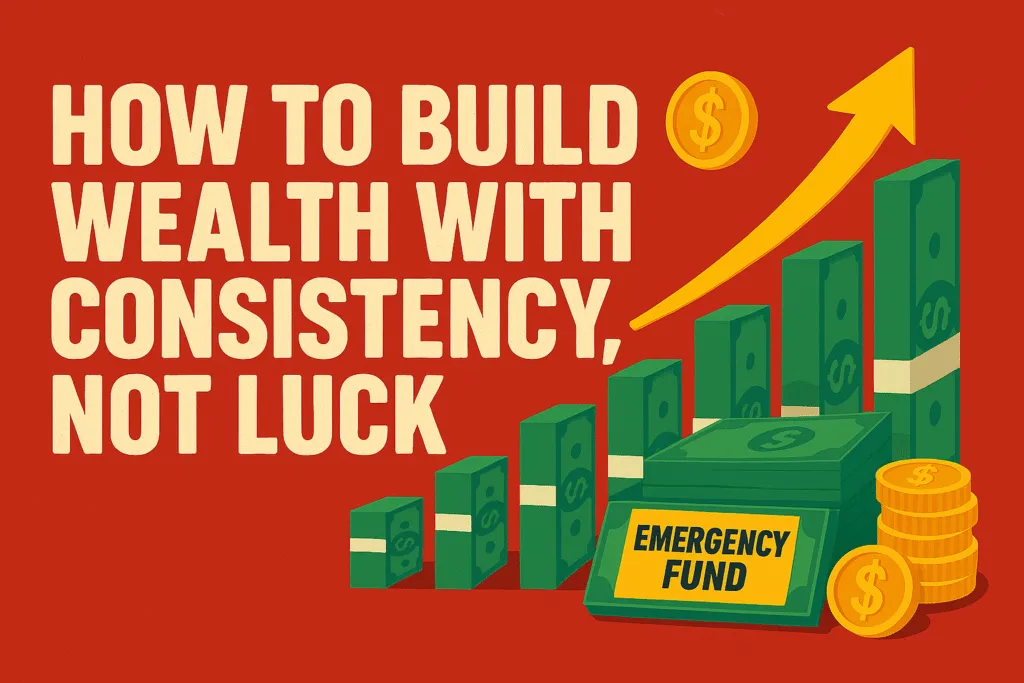

Introduction

Think building wealth is about luck? This guide will show you why consistency is the real game-changer—and how you can start today.

In a world full of quick fixes and instant success stories, many people believe that luck is the only way to build wealth. Whether it’s a viral crypto win, a sudden inheritance, or catching the stock market at the right time—these moments are rare and unpredictable. Yet, they dominate the narrative. It’s no wonder most individuals feel stuck, waiting for their “big break” rather than building wealth step by step.

The reality is very different. Wealth isn’t a lottery ticket—it’s a habit. It’s the small, smart decisions you make every day that compound over time. Budgeting monthly, investing regularly, avoiding unnecessary debt, and staying focused on long-term goals—these are the real foundations of financial success.

At Logic Matters, we’ve seen how this mindset shift can change everything. You don’t need to earn a fortune overnight. You need to stay consistent with the income you already have and use it wisely. Whether you’re a student, a working professional, or someone starting late, the path is still open.

This blog will guide you through that path. You’ll learn why most people never get started, what holds them back, and how you can break free from the luck-based thinking that keeps many stuck. More importantly, you’ll get practical, proven steps to start building wealth on your own terms—no shortcuts, no hype.

Because at the end of the day, luck fades—but consistency pays.

The Truth About Building Wealth

Wealth doesn’t happen by chance—it’s a result of deliberate effort, smart habits, and long-term thinking. Let’s break the illusion of instant success.

For most people, the idea of building wealth is tied to flashy headlines and overnight rags-to-riches stories. We hear about someone who made millions from a single stock pick or launched a startup that exploded in just a year. These stories are exciting—but they’re the exception, not the rule.

In reality, true wealth isn’t won. It’s built. It’s not about one lucky moment—it’s about consistent action over time. The world’s most financially secure individuals didn’t depend on a miracle. They followed a process. They spent less than they earned, invested the rest wisely, and stayed patient while their money grew.

The myth of overnight success is dangerous because it makes people believe they’re either too late or too unlucky. It creates a sense of urgency that pushes them toward risky decisions—like chasing hot stocks, investing in things they don’t understand, or trying to time the market.

But if you want to build wealth in the real world, you need to shift your focus from quick wins to long-term habits. Start by understanding your money, setting achievable goals, and building systems that support consistent growth—like automating savings or starting a simple SIP.

The journey might seem slow at first, but that’s where the magic of compounding kicks in. What looks like small progress today can lead to massive results over the years. So instead of wishing for your lucky break, focus on building your financial foundation one decision at a time.

That’s how real people build wealth—and that’s the truth the success stories often leave out.

Why Consistency Always Beats Luck

It’s not about doing one big thing right—it’s about doing the small things right, every single day. That’s how you truly build wealth.

While luck may give you a head start, it’s consistency that carries you to the finish line. Anyone can get lucky once—but building wealth that lasts requires discipline, patience, and repeated smart actions over time.

Daily habits are the foundation of financial success. Simple routines like tracking expenses, setting a monthly budget, saving a fixed percentage of your income, or investing every month may not feel exciting—but they’re powerful. These actions, done consistently, create momentum. Over time, they lead to real and measurable financial growth.

Look at any self-made millionaire, and you’ll find patterns. Warren Buffett started investing as a teenager and stuck with it for decades. Middle-class earners who retired comfortably didn’t rely on windfalls—they built wealth by living below their means and steadily contributing to their retirement accounts.

Even a small SIP of ₹500 a month can grow into several lakhs over time. That’s the power of consistency paired with compounding. The earlier you start, the better, but even starting late works if you stay consistent. You don’t need to earn more—you need to manage better.

Consistency also builds confidence. When you see results—however small—they motivate you to keep going. It becomes less about chasing a number and more about becoming someone who is financially disciplined.

Luck may come and go, but habits are in your control. And when your habits are aligned with your financial goals, you don’t just save—you build wealth. Slowly, steadily, and successfully.

Step-by-Step Plan to Build Wealth in 2025

If you want to build wealth in 2025, you don’t need a big breakthrough—you need a simple, consistent plan that actually works.

The biggest mistake people make when trying to build wealth is overcomplicating it. In reality, it all comes down to a few key steps that, when done consistently, deliver long-term results.

Start with clear financial goals. Do you want to build an emergency fund, buy a house, or retire early? Be specific. Set timelines and break big goals into smaller milestones. Clear goals give your money a purpose—and that’s what keeps you motivated.

Next, create and stick to a realistic budget. Track your income, list your expenses, and allocate money toward savings and investments before anything else. A budget isn’t about restriction—it’s about direction. It tells your money where to go instead of wondering where it went.

Once your budget is in place, automate your savings and investments. Set up auto-debits for SIPs, recurring deposits, or retirement accounts. This removes emotion and inconsistency from the equation. You won’t have to think twice—and that’s exactly what helps you stay on track.

Most importantly, start small and stay steady. You don’t need to invest ₹10,000 from day one. Even ₹500 a month matters if done regularly. What seems small today will grow with time—and so will your confidence and discipline.

This step-by-step plan may sound simple, but that’s the point. The easier it is to follow, the more likely you are to stick with it. And sticking with it is how you build wealth—not just in 2025, but for the rest of your life.

Top Habits of Consistent Wealth Builders

Wealthy people don’t rely on luck—they rely on habits. If you want to build wealth, these are the routines you need to make non-negotiable.

One of the clearest differences between people who struggle financially and those who steadily build wealth is their daily money behavior. It’s not about earning crores overnight. It’s about building simple, repeatable habits that support your financial goals.

First, consistent investing is key. Whether it’s through SIPs, index funds, stocks, or retirement plans, putting money into assets every month builds a strong financial base. You don’t have to time the market—just stay in it. Monthly investing allows your money to grow through compounding, regardless of market ups and downs.

Next, avoid lifestyle inflation. As income increases, so do temptations—better gadgets, bigger homes, frequent dining out. But consistent wealth builders know the importance of living below their means. They upgrade their lifestyle slowly, only after securing their financial future first.

Another smart habit is tracking your net worth regularly. This gives you a clear picture of your financial health. It helps you stay focused on long-term goals and celebrate real progress—not just salary hikes or random windfalls. Even a simple spreadsheet or app can keep you accountable.

These habits may not feel flashy, but they are incredibly effective. The best part? Anyone can adopt them—no matter your age or income level. The key is consistency, not perfection. You might miss a month or make a mistake, but getting back on track quickly is what truly counts.

If your goal is to build wealth, don’t wait for big changes. Start by changing small behaviors—and repeat them until they become part of who you are.

Common Pitfalls to Avoid in 2025

Building wealth is as much about avoiding mistakes as it is about doing the right things. In 2025, steer clear of these common traps.

In the pursuit to build wealth, many people unknowingly sabotage their own progress. These mistakes often seem harmless in the moment but can create long-term setbacks if left unchecked. Knowing what to avoid is just as important as knowing what to do.

The first trap is chasing quick gains. From viral crypto coins to “guaranteed” stock tips on social media, the temptation to make fast money is everywhere. But wealth built quickly is often lost just as fast. If it sounds too good to be true, it probably is. The real way to build wealth is through patience, not gambling.

Another common mistake is comparing your journey with others. Social media can make it feel like everyone else is getting rich while you’re falling behind. But what you see online is often filtered, exaggerated, or simply fake. Focus on your own financial path, your income, your goals—not someone else’s highlight reel.

Lastly, ignoring financial literacy is a major barrier. Earning money is just one part of the puzzle. Learning how to save, invest, protect, and grow it is what truly helps you build wealth. Yet most people don’t take the time to understand the basics, leaving their financial future to guesswork. To improve your money skills and protect your financial future, check out the Reserve Bank of India’s financial education resources.

2025 brings more financial tools, distractions, and opportunities than ever before. That makes it even more important to avoid shortcuts, stay grounded, and continue learning. The more informed and intentional you are, the stronger your wealth-building foundation becomes.

Mistakes are part of the journey—but when you learn to avoid the biggest ones, your progress becomes faster, steadier, and far more sustainable.

How Long Does It Really Take to Build Wealth?

Everyone wants to know how long it takes to build wealth. The answer? Longer than you think—but faster if you stay consistent.

One of the most common questions people ask is, “How long will it take me to build wealth?” While there’s no one-size-fits-all answer, the truth is: wealth is not built in days or months—it’s built over years. And the secret ingredient is compounding.

Compounding is the process of earning returns on both your original investment and the returns it has already generated. In simple words, your money starts earning money. Over time, this effect grows exponentially. But here’s the catch—it requires two things: consistency and patience.

Let’s say you invest ₹5,000 per month starting at age 25. With an average return of 12% annually, you could build a corpus of over ₹1 crore by the time you’re 45. But if you start 10 years later, the total drops drastically—even with the same monthly amount. That’s the power of time in compounding.

The earlier you begin, the more time your money has to grow. But even if you start late, staying consistent can still lead to significant wealth over 15–20 years. The key is not how fast you start—it’s how long you stay invested.

Many people give up too early because they expect quick results. But true wealth building is like growing a tree. You plant the seed, water it regularly, and give it time. Eventually, the results become visible—and then unstoppable.

If you want to build wealth, commit for the long haul. Don’t chase fast returns; chase sustainable habits. With time on your side, even small efforts can lead to massive outcomes.

Bonus Tips for Staying Consistent

The hardest part of building wealth isn’t starting—it’s staying consistent. These tips will help you stay on track without burning out.

Once you understand how to build wealth, the next challenge is sticking with the process. Life gets busy, expenses creep in, and motivation can fade. That’s why staying consistent requires more than just good intentions—it needs systems that support your habits.

Start by using technology to automate your finances. Set up automatic transfers to savings, SIPs, or investment accounts. Use budgeting apps to track your expenses without manual effort. Automation removes the need for willpower and helps you build wealth without constant reminders.

Next, build accountability into your routine. Share your financial goals with a trusted friend, join an online finance group, or follow creators who focus on long-term money habits. Having a support system—even a digital one—keeps you motivated and makes the journey less lonely.

Another powerful strategy is to revisit your goals every quarter. What worked? What didn’t? Are you saving enough? Are your expenses creeping up? A 15-minute review every three months helps you adjust before you fall off track. It also keeps your goals top-of-mind and reminds you why you started.

Consistency doesn’t mean perfection. You will miss a few months, spend impulsively, or fall short sometimes—and that’s okay. What matters is getting back on track quickly.

To build wealth, you need tools that save time, people who keep you motivated, and regular check-ins that realign your focus. The more consistent your systems are, the less you’ll need to rely on motivation alone.

Because in the long run, those who stay steady—not those who start fast—are the ones who actually build wealth.

Conclusion

Building wealth doesn’t require luck, a high income, or perfect timing. What it really takes is commitment, patience, and the courage to start.

Throughout this guide, one theme has remained constant: you don’t need luck to build wealth—you need consistency. Every financially successful person you admire got there by making small, smart decisions over and over again. Not by waiting for a jackpot, but by showing up for their future self every day.

When you automate your savings, invest regularly, control your spending, and stay disciplined over time, wealth becomes inevitable. There’s no magic moment, no perfect year. Just habits done right, again and again.

Yes, it can feel slow in the beginning. You may not see huge gains in the first year. But stick with it, and you’ll see what most people miss: the quiet power of compounding, the confidence that comes with control, and the freedom that financial stability brings.

Don’t fall into the trap of waiting—waiting for a raise, for the markets to improve, or for your “lucky break.” The best time to start was yesterday. The next best time is today.

At the end of the day, your money story is yours to write. And the earlier you take control of it, the better your future will look. You don’t have to do everything at once. Just pick one habit and start small.

Stay consistent. Stay patient. And most importantly, believe that you can build wealth—because you absolutely can.

Your future self will thank you for the steps you take today.

Also Read: Emergency Fund in 2025: Avoid Financial Disaster Before It’s Too Late.

FAQs

Q1. Can I build wealth with a low income?

Yes, absolutely. Building wealth isn’t about how much you earn—it’s about how much you consistently save, invest, and manage wisely. Even small amounts, when invested regularly, can grow significantly over time thanks to compounding.

Q2. Do I need to invest in risky assets to build wealth?

No. You don’t need to take high risks. A balanced approach using tools like SIPs, index funds, or conservative long-term strategies can help you build wealth steadily without exposing yourself to unnecessary volatility.

Q3. How long does it usually take to build wealth?

It depends on your income, expenses, and how early you start. On average, it takes 10–20 years of consistent effort to reach true financial independence. The earlier you begin, the faster you’ll see results.

Q4. What’s the best age to start building wealth?

The best time to start is right now. Whether you’re 20 or 50, consistent effort matters more than timing. Starting early gives your money more time to grow, but it’s never too late to begin.

Q5. How can I stay motivated during the wealth-building journey?

Set clear goals, track your progress, and remind yourself why you started. Surround yourself with like-minded people and use tools to automate your finances. Motivation comes and goes—but habits last.

Q6. Is it okay to make mistakes along the way?

Yes. Mistakes are part of the process. What matters is learning from them and staying consistent. You don’t need to be perfect to build wealth—you just need to keep moving forward.