Introduction

In today’s digital-first world, staying connected is easier than ever—but it also comes with new risks. From fake emails to deceptive UPI requests, online scams are becoming smarter, faster, and harder to detect. Every click, message, or transaction can be a potential trap if you’re not paying attention. That’s why it’s more important than ever to stay alert and informed to avoid online scams that could cost you your money, identity, or peace of mind.

Scammers are no longer just after your passwords; they’re targeting your trust. Whether it’s a too-good-to-be-true deal, a fake customer care call, or a cloned payment app, the tactics are getting more advanced. Even tech-savvy users can fall for well-crafted traps if they let their guard down for just a second. And let’s be honest—most people don’t expect to get scammed until it happens to them.

The good news is that a little awareness goes a long way. You don’t need to be a cybersecurity expert to protect yourself. Just understanding how these scams work and recognizing the early warning signs can save you a lot of trouble. This blog, powered by Logic Matters, is here to break down the red flags and give you smart, simple tips that you can actually use—without the jargon.

If you’ve ever asked yourself, “Can this message be trusted?” or “Is this website safe to use?”, you’re not alone. As a tech blogger, I believe digital safety should be part of everyone’s daily habits. Because in the online world, prevention really is better than cure. So let’s dive in and learn how to navigate safely through the digital noise.

Most Common Types of Online Scams

The internet has opened up endless possibilities—but it has also become a breeding ground for scammers. With more people shopping, paying, and communicating online, cybercriminals have more ways to exploit trust. Whether you’re a regular smartphone user or someone who spends hours online for work, it’s crucial to understand the most common types of scams that could target you at any time.

Let’s take a closer look at the most dangerous and widespread online scams today.

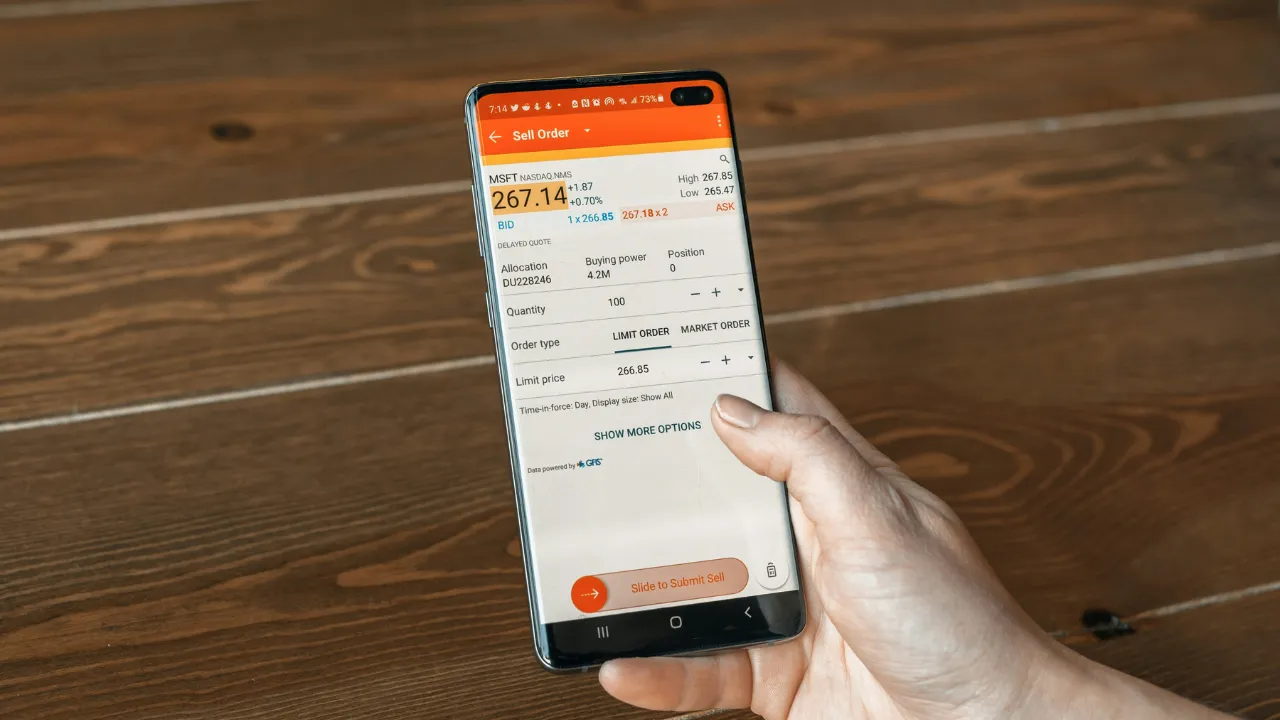

UPI & Banking Frauds

In countries like India where UPI has become a major part of digital payments, scammers are getting more creative. They often pose as customer service agents or sellers, sending links that look official. You might get a call saying, “We’re issuing your refund—please share your UPI ID,” or be told to scan a QR code to receive money. What most don’t realize is that QR codes can also be used to send money. Once you enter your UPI PIN or OTP, the scammer has full control over your account.

Some fraudsters even create lookalike apps that mimic popular banking platforms. These fake apps are available outside the official app stores and silently capture your credentials. Once inside your account, they drain your funds within minutes.

Phishing Emails & Fake Websites

Phishing is one of the oldest and most common tricks in the book. You receive an email from what appears to be your bank, courier company, or even a streaming service, saying there’s an urgent issue—your account is blocked, a payment failed, or you need to confirm your details. These emails contain links to websites that look identical to the real ones but are designed to steal your login credentials.

Some phishing attacks go a step further by attaching malware or ransomware to downloadable files. One careless click, and your system may be compromised.

Fake Job Offers & Lottery Scams

You open your inbox and find an exciting job offer from a well-known company—high salary, remote work, flexible hours. All they ask for is a “small registration fee” or your Aadhaar and PAN card for verification. Sounds too good to be true? That’s because it is.

Scammers prey on job seekers and those hoping for quick success. They also use fake lottery messages—“Congratulations, you’ve won ₹25 lakh!”—to lure victims into sending personal documents and payment for processing charges. Once paid, the scammer vanishes.

Tech Support Scams

Ever received a popup saying, “Your computer is infected! Call this number immediately”? These scams target fear. The moment you call, a fake technician will convince you to install remote access software. They may walk you through steps that make your screen go black—while they secretly browse your files, install spyware, or demand a payment to “fix” the issue.

Some scammers even call directly, claiming they’re from Microsoft or Apple and that your device is part of a criminal investigation. Their goal is always the same: gain access and control.

Social Media Impersonation

Social media platforms are a goldmine for scammers. They create fake accounts that look just like someone you know—using the same profile picture, name, and even mutual connections. Then comes the message: “Hey, can you help me out? I need money urgently.” Many people fall for this trick, especially when it comes from a familiar face.

In other cases, brands and influencers are impersonated. Victims are offered fake giveaways, free items, or exclusive offers, all to collect payment or card information under the guise of a legitimate deal.

Understanding these tactics isn’t about making you paranoid—it’s about making you aware. Once you recognize how these scams work, you’re already much harder to fool.

So if you want to avoid online scams, start by learning how to spot them. Trust your instincts, double-check everything, and remember: if something feels off, it probably is.

Top Red Flags to Spot an Online Scam

Spotting an online scam isn’t always easy—scammers have become more polished, and their tricks are evolving. But no matter how advanced their techniques get, most scams still carry certain warning signs. The key is knowing what to look for before it’s too late. Here are the top red flags that can help you recognize and avoid online scams before falling into a trap.

Unbelievable offers

“If it sounds too good to be true, it probably is.” That old saying is still spot on when it comes to online safety. Whether it’s a new iPhone for ₹499 or a job that pays ₹1 lakh per week with zero experience—these offers are often designed to lure victims into sharing personal details or making upfront payments. Scammers know that excitement can cloud judgment. If an offer feels unreal or makes you say “this can’t be true,” that’s your first red flag.

Poor grammar or design

Scam messages, emails, and websites often have noticeable spelling mistakes, odd sentence structures, or low-quality visuals. While some scammers are getting better at looking “professional,” many still slip up with awkward language or design that doesn’t match the original brand. Real companies invest in polished communication; scammers usually don’t. If you see an email with blurry logos or a WhatsApp message full of typos, pause and investigate.

Urgency or pressure tactics

Scammers thrive on panic. They’ll tell you your bank account is about to be frozen, your parcel can’t be delivered, or your computer has been hacked—and you must act immediately. This sense of urgency is deliberate. The goal is to push you into making a quick decision without thinking clearly. Real companies don’t usually rush you like this. Any time you’re pressured to click, pay, or share information “right now,” it’s time to step back.

Requests for personal or financial info

One of the clearest red flags is when someone you don’t know asks for sensitive information—bank details, UPI PIN, OTP, passwords, or Aadhaar number. No genuine organization will ever ask for these over email, message, or call. If someone claims to be from your bank or a government agency and asks for this information, assume it’s a scam unless proven otherwise.

Suspicious links or attachments

A common scam tactic is to send you a link or file that looks normal but leads to trouble. These could redirect you to fake websites that steal your login credentials or install malware on your device. Always hover over a link (on desktop) or long-press (on mobile) to preview the URL before clicking. Be especially cautious with files sent through unknown emails or unexpected messages—even if they appear to come from someone you know.

Scams are often disguised in everyday interactions—an SMS from your “bank”, a Facebook message from a “friend”, or a random call from “tech support.” But these red flags are your early warning system. Recognize them, and you’re already ahead of the scammer. Staying alert doesn’t require paranoia—just awareness and a few seconds of extra thinking. That’s often all it takes to avoid online scams.

Smart Safety Tips to Protect Yourself

Protecting yourself from online scams starts with simple habits and smart choices. The digital world is vast and sometimes risky, but with the right approach, you can minimize your chances of falling victim. Here are some effective tips that anyone can follow to stay safe and secure online.

First, always be cautious before clicking any links or downloading attachments, especially if they come from unknown sources. Scammers often use fake emails or messages that look genuine but lead to harmful websites or install malware. When in doubt, don’t click. Instead, verify the source by contacting the company or person directly through official channels.

Next, use strong and unique passwords for every online account. Avoid common words, names, or simple number sequences. Consider using a trusted password manager to generate and store complex passwords safely. This reduces the risk of your accounts being hacked in case one platform is compromised.

Two-factor authentication (2FA) is another powerful tool. It adds an extra layer of security by requiring a second verification step, like a code sent to your phone, in addition to your password. Enabling 2FA wherever possible significantly lowers the chances of unauthorized access.

Always keep your software, apps, and operating systems up to date. Developers regularly release updates to fix security vulnerabilities that scammers could exploit. Ignoring these updates leaves your device exposed.

Be mindful when sharing personal information online. Avoid posting sensitive details such as your full address, phone number, or financial information on social media or untrusted websites. The less data available publicly, the harder it is for scammers to target you.

When making online payments, use trusted and secure payment methods. Look for websites that use HTTPS and display a padlock icon in the browser address bar. Avoid making transactions over public Wi-Fi networks, as these can be insecure and easy to intercept.

Finally, stay informed about the latest scams and tactics. Scammers continuously change their methods, so staying updated helps you recognize new threats quickly. Follow reliable sources, official government portals, or tech blogs for the latest alerts and advice.

By following these smart safety tips, you create multiple barriers against fraudsters. Protecting yourself online doesn’t require special skills—just awareness and simple, consistent actions. With these habits in place, you’ll be much better equipped to avoid online scams and keep your personal information secure.

What to Do If You’ve Been Scammed

Falling victim to an online scam can be distressing, but acting quickly can help reduce the damage. If you realize you’ve been scammed, here are the important steps you should take immediately.

First, stop all communication with the scammer. Don’t respond to further messages or calls, as this could expose you to more risks or additional scams. Block their phone number, email address, or social media profile to prevent them from contacting you again.

Next, secure your accounts. Change passwords for your email, banking apps, and any other accounts that might be affected. If you haven’t already, enable two-factor authentication (2FA) to add an extra layer of protection.

If the scam involved your bank account or UPI, contact your bank immediately. Report the fraudulent transaction and ask them to block or freeze your account to prevent further losses. Most banks have dedicated fraud helplines for such situations.

It’s also crucial to report the scam to the proper authorities. In India, you can file a complaint with the National Cyber Crime Reporting Portal. Provide all relevant details like messages, emails, transaction IDs, and screenshots to help the investigation. For other countries, check local cybercrime units or government websites for the correct channels.

Additionally, inform the platform where the scam took place—whether it’s WhatsApp, Facebook, an online marketplace, or an email provider. Reporting helps them take down scam accounts and warn other users.

Finally, monitor your accounts regularly for any suspicious activity. Keep an eye on bank statements, credit reports, and your email for unauthorized transactions or password reset attempts. Early detection can prevent bigger problems.

Remember, being scammed is not your fault—these criminals are skilled at deception. What matters most is how you respond. Acting fast and following these steps can protect your money, personal information, and peace of mind.

Official Resources for Reporting Online Scams

Knowing where to report online scams is just as important as recognizing them. Reporting helps authorities take action against fraudsters and can also protect others from falling victim.

If you’re in India, the primary platform to report cybercrime, including online scams, is the National Cyber Crime Reporting Portal. This government-run website allows you to file complaints related to financial fraud, identity theft, phishing, and more. The process is straightforward, and you can upload evidence like screenshots and transaction details to support your case.

The Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI) also provide helplines and guidelines for reporting UPI and banking-related frauds. If your bank account or UPI has been compromised, contacting your bank’s fraud department immediately is crucial.

CERT-In (Indian Computer Emergency Response Team) is another key agency working on cybersecurity issues. While they don’t handle individual complaints, their advisories and updates are valuable for staying informed about new scams and vulnerabilities.

For scams happening on social media platforms, each site usually has a reporting mechanism. Facebook, WhatsApp, Twitter, and Instagram allow users to report suspicious accounts, messages, or content directly through their apps or websites.

If you’re outside India, look for your country’s official cybercrime reporting agency or police department’s cyber division. Many countries have dedicated portals and helplines to help victims of online fraud.

Remember, timely reporting not only increases the chances of recovering your losses but also helps authorities track down criminals and prevent future scams. Always keep a record of your reports and any reference numbers for follow-up.

Conclusion

Online scams are becoming more sophisticated, but staying informed and cautious can make all the difference. By learning to recognize common scam types and spotting the top red flags, you empower yourself to avoid online scams before they cause harm. Simple habits like using strong passwords, verifying sources, and reporting suspicious activity not only protect you but also help create a safer digital space for everyone. Remember, your awareness is your best defense—stay alert, think twice before sharing personal information, and keep your digital life secure.

Also Read: How to Save Money on Low Income in 2025 – Smart & Practical Tips

Frequently Asked Questions (FAQs)

1. Can banks refund money lost due to online scams?

Banks may refund money if you report the fraud quickly and follow their dispute process. However, refunds are not guaranteed, especially if account details or OTPs were shared. Always notify your bank immediately after discovering fraud.

2. Is UPI safe to use for online transactions?

UPI is generally safe when used carefully. Always verify payment requests, never share your UPI PIN or OTP, and avoid clicking suspicious links to reduce the risk of fraud.

3. How can I report an online scam in India?

You can report online scams through the National Cyber Crime Reporting Portal. Provide detailed information and evidence to help authorities investigate the case.

4. What should I do if I receive a suspicious email or message?

Do not click on any links or download attachments. Verify the sender’s identity through official channels and report the message to your email provider or messaging app.

5. How can I protect my social media accounts from impersonation scams?

Use strong, unique passwords and enable two-factor authentication. Be cautious about friend requests or messages asking for money or personal information—even if they appear to come from someone you know.