How to Secure Your Money in the First 30 Minutes After Phone Theft

Realizing your phone has been stolen can be one of the most stressful moments in your day. Beyond losing an expensive device, phone theft exposes your financial accounts, digital wallets, and personal information to criminals. Acting fast in the first 30 minutes can mean the difference between preventing financial loss and dealing with unauthorized transactions later.

In this guide, you’ll learn exactly what to do right now after your phone gets stolen to secure your money and financial accounts. These are practical, real-world steps you can follow immediately—even before you file a police report or get a replacement phone.

Immediate Steps to Take After Phone Theft

The key during phone theft is to act quickly and with purpose. Start with stopping access to your financial information first.

1. Stay Calm and Confirm the Theft

First, take a breath. Whether it was snatched in a crowd or misplaced somewhere unknown, confirm that it actually was stolen and not lost nearby. Sometimes retracing your steps helps, but once you’re sure it’s gone, you need to focus on security.

2. Block or Lock Your Phone Remotely

Use the built-in remote device tools as your first line of defense:

- Android: Visit android.com/find from any browser, sign in, and choose “Secure Device” to lock the phone and prevent access.

- iPhone (iOS): Use the Find My iPhone feature via iCloud.com to lock your phone and display a message.

Locking keeps thieves from accessing apps, messages, and potentially your banking apps if they haven’t already logged in.

3. Notify Your Mobile Network Provider Immediately

As soon as you realize a theft has occurred, contact your carrier:

- Tell them your phone was stolen.

- Ask them to block your SIM or suspend the number.

- Request a replacement SIM/eSIM if possible.

Blocking the SIM helps stop thieves from receiving OTPs (one-time passwords) used for banking and financial app authorizations.

Secure Your Financial Accounts Fast

In the next few critical minutes after phone theft, your goal shifts to protecting your bank accounts, digital wallets, and payment apps.

1. Contact Your Bank and Payment Services

Call your bank’s fraud hotline first if you suspect your mobile banking app was access-enabled on the missing device. Many banks allow 24/7 reporting. They can:

- Temporarily block access to your mobile banking app.

- Freeze debit/credit cards stored in digital wallets.

- Alert you about suspicious transaction attempts.

This step alone can prevent large, unauthorized withdrawals.

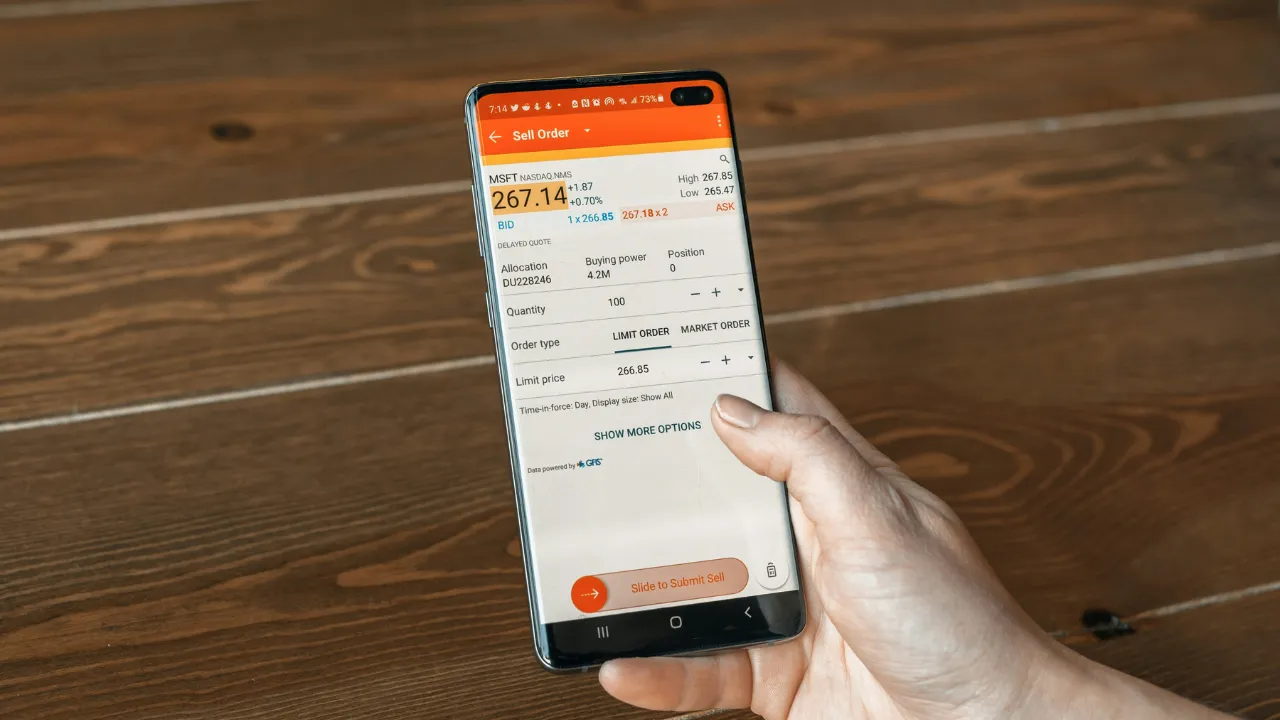

2. Remove Cards from Digital Wallets

If you had Apple Pay, Google Pay, Samsung Pay, or similar wallets on your stolen phone:

- Log in to your wallet account from a secure device (laptop or friend’s phone).

- Remove all stored cards manually.

- Confirm with your banks that those cards are deregistered from mobile wallets.

This cuts off the thief’s ability to use your stored cards for contactless or online spending.

3. Change Passwords on Key Accounts

Even if thieves can’t immediately log into your accounts, resetting passwords adds an extra layer of protection:

- Banking app passwords

- Email accounts (often the recovery method for financial passwords)

- Digital wallet accounts

- Cloud accounts (Google, Apple ID)

Most systems also give you an option to force logout on all devices, which can shut out someone trying to access your accounts elsewhere.

4. Enable Two-Factor Authentication (2FA) on Secure Device

If you haven’t used strong 2FA already, now’s the time:

- Set up 2FA via email or authentication apps on your replacement or trusted device.

- Avoid using SMS for 2FA once SIM access is compromised.

Good 2FA settings make it much harder for thieves to break into your financial accounts.

Notify Local Authorities and Get a Record

Although your immediate priority is securing money, reporting the theft helps with future insurance claims and tracking.

1. File a Police Report

Report the phone theft to law enforcement. Provide:

- Phone model and IMEI number (you can find this on the box or purchase receipt).

- Time and place of theft.

- Tracking attempt details from Find My Device or Find My iPhone.

A police report may not get your phone back instantly—but it’s crucial for insurance and identity protection.

2. Document Everything

Keep a record of:

- Calls to banks and network providers.

- Screenshots of account changes.

- Zero-balance confirmations from banks.

This documentation supports fraud investigations and insurance claims if any money was lost.

Extra Tips to Protect Yourself After Phone Theft

After the first 30 minutes, continue your security sweep with these helpful actions.

1. Watch for Fraudulent Transactions

Monitor all financial accounts closely in the next few days. Look for:

- Unrecognized debits or credits

- Suspicious UPI/QR payments

- Unexpected emails about password resets

Report any unauthorized activity immediately to your bank.

2. Notify Friends and Contacts

Thieves may try to impersonate you via messaging or social accounts to trick contacts into sending money. Alert your close circle that your phone was stolen and not to trust unusual requests from you.

3. Prepare for the Next Device

Before getting a new phone:

- Enable strong lock screen security.

- Activate remote tracking.

- Set up SIM PIN protection.

- Keep a note of your device’s IMEI and serial number in a safe place.

These pre-emptive steps reduce danger from future phone theft incidents.

Final Thoughts

Phone theft doesn’t just take a device—it exposes a gateway to your life and finances. The first 30 minutes after theft are a race against time to stop thieves from using your information.

By locking your phone, contacting your network and bank, changing passwords, and removing payment methods, you can protect your money and accounts from unauthorized access.

Phone theft can happen to anyone. What matters most is how quickly and confidently you act. Staying calm, following the steps above, and preparing ahead can turn a crisis into a manageable event.

Also Read: Imran Khan’s Surprise Bollywood Comeback! – Logic Matters