Introduction: Why Smart Budgeting Matters More Than Ever

In today’s fast-moving digital world, where online spending is just a tap away, managing personal finances has become more critical than ever. Whether you’re a college student, working professional, or freelancer, smart budgeting for everyone is not just a financial strategy—it’s a life skill. Platforms like Logic Matters aim to simplify complex financial ideas for everyday people, and budgeting is one of the most fundamental ones.

But what exactly is budgeting? At its core, budgeting means creating a plan for how you’ll spend and save your money. It helps you take control of your income, track your spending, and make sure you’re always prepared for both expected and unexpected expenses. In short, budgeting puts you in charge of your money, not the other way around.

Why is this important today? Because we live in a world where digital transactions, EMIs, subscriptions, and UPI payments can easily blur the line between needs and wants. Without a proper plan, it’s easy to overspend, fall into debt, or fail to save for important life goals. That’s why smart budgeting for everyone has become a universal need—whether you earn ₹10,000 or ₹1 lakh a month.

Understanding how to budget smartly ensures financial freedom, peace of mind, and the ability to make future-focused choices. As we dive deeper into methods like the 50-30-20 rule, you’ll see how simple steps can lead to major long-term benefits.

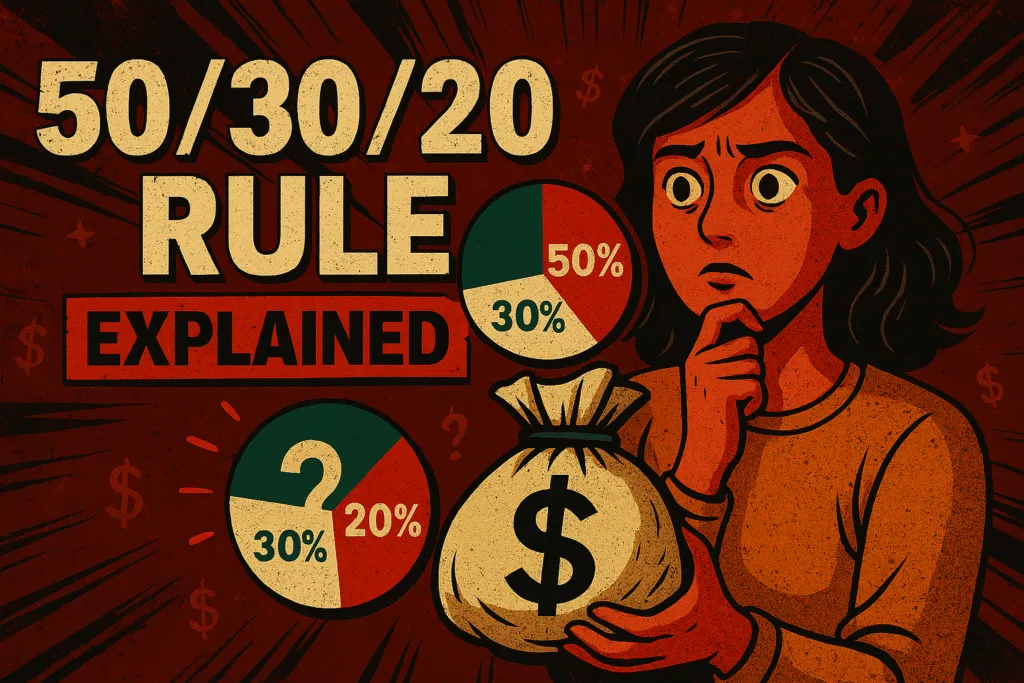

What is the 50-30-20 Rule?

The 50-30-20 rule is a simple yet powerful method of managing your personal finances. It gained popularity through Elizabeth Warren, a U.S. senator and bankruptcy expert, who introduced the concept in her book “All Your Worth”. The goal was to create an easy-to-follow budgeting rule that anyone could apply—regardless of their income level. Today, it’s used globally by people who want a smarter, more structured approach to handling their money. At Logic Matters, we believe such practical frameworks are essential in promoting smart budgeting for everyone.

So, what does the rule actually say? It suggests dividing your after-tax income into three clear spending categories:

50% for Needs – These are essential expenses like rent, groceries, electricity, transportation, and medical bills. Simply put, these are things you cannot live without.

30% for Wants – This portion is for non-essentials that add comfort or enjoyment to your life, like streaming subscriptions, dining out, shopping, or weekend getaways.

20% for Savings & Debt Repayment – This part goes toward building your emergency fund, investing for the future, or repaying loans and credit card bills.

The beauty of the 50-30-20 rule lies in its simplicity. It doesn’t require spreadsheets or complicated formulas—just a clear understanding of your income and priorities. Whether you’re tech-savvy or just starting your financial journey, this method offers a clean starting point for smart budgeting. And once you apply it consistently, you’ll begin to notice more control, clarity, and confidence in your financial life. The 50-30-20 rule was popularized by U.S. Senator Elizabeth Warren and has been widely covered by financial platforms like Investopedia.

50% – Needs: Covering Your Essentials First

When applying the 50-30-20 rule, the first and most crucial category is Needs, which takes up 50% of your after-tax income. These are the non-negotiables—the expenses that keep your life running. If you don’t pay for them, your basic day-to-day functioning is directly impacted. In the context of smart budgeting for everyone, clearly identifying what counts as a “need” is the foundation for managing your money responsibly.

So, what exactly qualifies as a need? Think of it as anything you absolutely must have to survive and maintain stability. This includes essentials like:

- Rent or Home Loan EMIs – Your living space is a basic necessity, whether you’re renting or paying off a mortgage.

- Groceries – Food is a fundamental human need, but this category doesn’t include dining out or fancy snacks—just the essentials for nutrition.

- Utility Bills – Electricity, water, internet, and mobile phone bills all fall under needs, especially in today’s digitally connected world.

- Transportation – Daily commute costs, whether by public transport, fuel, or basic car maintenance, are part of this 50%.

- Healthcare – Regular medications, doctor visits, and health insurance premiums also count as necessary expenses.

It’s important not to confuse needs with wants. For example, a basic mobile data plan is a need, but a premium entertainment pack is a want. By drawing this line clearly, you ensure that your financial priorities are aligned with reality. Logic Matters promotes this clarity because it makes smart budgeting for everyone practical, not just theoretical.

The goal is to keep this category within 50% of your income—if it’s higher, you may need to reassess or downsize certain aspects of your lifestyle.

30% – Wants: Enjoying Life Without Overspending

The second part of the 50-30-20 rule is all about Wants, which should ideally take up no more than 30% of your after-tax income. This category includes the things that make life more enjoyable, but aren’t essential for survival. Understanding this difference is key to smart budgeting for everyone, especially in today’s world where digital convenience makes spending easier than ever.

So, how do you differentiate a want from a need? A simple way to check is: if you can live without it and still meet your basic requirements, it’s likely a want. You might need a smartphone, but upgrading to the latest model every year? That’s a want. You need food, but dining out at a fancy restaurant? That’s a want too.

Common examples of wants include:

- Entertainment – Movie nights, OTT platform subscriptions, music streaming services

- Dining Out – Cafes, takeout, food delivery apps

- Hobbies & Leisure – Gaming, shopping, gadgets, travel

- Subscriptions – Premium apps, online learning platforms (unless essential for your job)

While these are not must-haves, they add value to your lifestyle and are completely okay to enjoy—as long as they stay within the 30% boundary. The purpose of this segment isn’t to deprive you, but to help you stay in control of optional spending.

At Logic Matters, we always advocate balance. Smart budgeting for everyone doesn’t mean cutting out fun—it means making room for enjoyment without sacrificing savings or essentials. So go ahead and spend on the things you love—but do it consciously, not compulsively.

20% – Savings & Debt Repayment: Securing Your Financial Future

The final 20% of the 50-30-20 rule is where real financial growth begins. This portion of your income should go toward building your savings, investing for the future, and repaying any existing debt. It’s the most crucial step in ensuring long-term stability, and it’s often the one most people overlook. But in the world of smart budgeting for everyone, this 20% is non-negotiable.

First, let’s break it down:

- Emergency Fund – This acts as your financial safety net. Ideally, you should aim to save at least 3–6 months’ worth of living expenses. It helps you handle sudden job loss, medical issues, or any unplanned situation without falling into debt.

- Investments – Whether it’s a SIP in mutual funds, PPF, NPS, or other low-risk options, investing ensures that your money grows over time. Even small, regular investments can compound into significant wealth in the long run.

- Loan Repayments – This includes clearing high-interest debts like credit card bills or personal loans. Prioritizing these helps reduce your financial burden and improves your credit score over time.

Now, how can you use this 20% smartly?

Start by automating your savings and EMIs right after you receive your income. This way, you treat saving like a mandatory expense, not an optional one. Also, try increasing your savings rate when your income grows instead of increasing your lifestyle costs. Avoid risky shortcuts like get-rich-quick schemes, and focus on consistent, disciplined planning.

By using this 20% wisely, you not only protect your present but also strengthen your future. It’s the key to moving from paycheck-to-paycheck living to true financial independence.

How to Calculate Your 50-30-20 Budget

Now that you understand the 50-30-20 rule, the next step is applying it to your own income. The beauty of smart budgeting for everyone is that it works no matter how much you earn—what matters is how you manage what you have. Let’s go through a simple step-by-step method to calculate your budget and stay financially balanced.

Step-by-Step Budgeting Using Your Income:

- Know Your Monthly Take-Home Income

This is your net income—after tax, PF, and other deductions. For salaried individuals, it’s the in-hand amount you receive. - Apply the 50-30-20 Formula

Divide your income into three parts:- 50% for Needs

- 30% for Wants

- 20% for Savings & Debt Repayment

- Assign Categories to Each Section

Start listing your monthly expenses under each category based on the definitions we discussed earlier.

Real-Life Examples:

Let’s apply this to two common salary slabs:

🪙 Example 1: ₹30,000 Salary (Take-Home)

- Needs (50%) = ₹15,000 → Rent: ₹6,000, Groceries: ₹3,000, Utilities: ₹2,000, Commute: ₹4,000

- Wants (30%) = ₹9,000 → OTT Subscriptions: ₹500, Dining Out: ₹2,500, Mobile Upgrade EMI: ₹6,000

- Savings (20%) = ₹6,000 → SIP: ₹2,000, Emergency Fund: ₹2,000, Credit Card EMI: ₹2,000

🪙 Example 2: ₹50,000 Salary (Take-Home)

- Needs (50%) = ₹25,000 → Rent: ₹10,000, Groceries: ₹4,000, Utilities: ₹3,000, Transport: ₹8,000

- Wants (30%) = ₹15,000 → Travel: ₹5,000, Shopping: ₹4,000, Subscriptions: ₹1,000, Dining: ₹5,000

- Savings (20%) = ₹10,000 → SIP: ₹4,000, FD: ₹3,000, Loan Repayment: ₹3,000

With this simple math, smart budgeting for everyone becomes easy to implement. Just plug in your numbers, adjust as needed, and review monthly to stay on track.

Tools to Help You Apply the Rule

While the 50-30-20 rule is simple in theory, applying it consistently requires a little support—especially when life gets busy. Thankfully, there are plenty of tools that make smart budgeting for everyone more practical and sustainable. Whether you prefer digital apps or manual tracking, you can find a method that suits your style and goals.

1. Budgeting Apps (Indian & Global)

If you prefer automation and real-time insights, budgeting apps can be your best friend. Here are some popular choices:

- Walnut (India) – Tracks expenses directly from SMS and bank messages, offering automatic categorization and monthly insights.

- Money View (India) – Allows you to set monthly budgets, track bill payments, and monitor credit score—all in one place.

- Goodbudget – Based on the envelope system, this app is great for couples or families managing shared finances.

- YNAB (You Need A Budget) – One of the most trusted global tools for building financial discipline through proactive budgeting.

- Mint – Popular in many countries, it links to your bank account and gives you a full financial picture with spending trends and reminders.

2. Excel/Google Sheets Templates

Prefer a hands-on approach? Spreadsheets are still one of the most flexible tools out there. You can start from scratch or use free templates available online tailored for the 50-30-20 rule. These allow you to:

- Input your income and auto-calculate 50-30-20 splits

- Categorize expenses manually

- Track your savings progress month-by-month

- Visualize your budgeting with pie charts and graphs

Google Sheets has the added benefit of cloud access and mobile compatibility, making it easy to update your budget on the go.

Whichever tool you choose, consistency is key. By using the right tools, smart budgeting for everyone becomes less of a chore and more of a daily habit that brings clarity and peace of mind.

Advantages of the 50-30-20 Rule

The reason the 50-30-20 rule has stood the test of time is because it’s both practical and adaptable. When it comes to smart budgeting for everyone, this method offers a strong foundation that balances daily needs, lifestyle choices, and long-term goals—all without complex calculations or confusing jargon.

1. Simplicity

The biggest strength of the 50-30-20 rule lies in its simplicity. Unlike detailed budgeting systems that require constant monitoring and categorization, this rule breaks down your income into just three easy-to-understand parts. Whether you’re new to budgeting or don’t enjoy tracking every rupee, this approach makes it possible to manage your money in minutes.

2. Flexibility

Not everyone has the same financial situation, and that’s where the 50-30-20 rule shines. You can tweak it slightly based on your lifestyle, income level, or financial goals. For instance, if you have fewer wants and more debt, you might shift to a 50-20-30 model. The formula isn’t rigid—it grows with you. This makes smart budgeting for everyone a practical reality, not a one-size-fits-all theory.

3. Financial Discipline

Perhaps the most underrated benefit of this rule is that it builds discipline. By following a fixed structure each month, you create healthy financial habits. It encourages saving before spending and helps you stay mindful of how much you’re allocating to non-essential areas. Over time, this habit turns into a lifestyle that leads to stability and peace of mind.

In short, the 50-30-20 rule is more than just a budgeting trick—it’s a mindset that empowers you to take control of your money without overcomplicating your life.

Limitations & Common Mistakes of the 50-30-20 Rule

While the 50-30-20 rule is a great starting point for managing your finances, it’s not perfect. Like any budgeting method, it has its limitations—especially when applied without understanding your unique financial situation. Even though it supports smart budgeting for everyone, knowing its downsides can help you use it more effectively.

1. One Size Doesn’t Fit All

The biggest limitation is that this rule assumes a fixed ratio works for everyone. But in reality, people have different priorities and challenges. For someone living in a metro city with high rent, the “Needs” may exceed 50% easily. Similarly, a student or someone with no financial responsibilities might not need 30% for “Wants” and could benefit more from increasing savings. If your income is too low or your expenses are unusually high, sticking strictly to this formula can feel unrealistic or restrictive.

2. Misclassifying Needs and Wants

Another common mistake is blurring the line between needs and wants. For example, you need a mobile phone, but upgrading to the latest model every year is a want. Dining out might feel like a basic expense, but it falls under lifestyle, not necessity. Misclassifying expenses can throw your entire budget off balance and give a false sense of financial control. This is where honesty and awareness play a big role.

To avoid these mistakes, it’s important to adapt the rule to your own lifestyle and regularly review your spending patterns. Smart budgeting for everyone isn’t about perfection—it’s about progress. Use the 50-30-20 rule as a guide, not a rulebook, and tweak it as your life evolves.

When & How to Adjust the Rule

The 50-30-20 rule offers a solid structure for managing money, but it’s not carved in stone. Everyone’s financial situation is different, and sometimes sticking rigidly to this formula can do more harm than good. That’s why smart budgeting for everyone also means knowing when—and how—to tweak the rule to fit your real-life needs.

For Students, Freelancers, or Low-Income Earners

If you’re a student with no steady income or someone in the early stages of freelancing, your income may be irregular or limited. In such cases, allocating 30% to “Wants” might not be practical. A more realistic breakdown could be:

- 60% Needs

- 10% Wants

- 30% Savings/Debt or Emergency Fund (even if small)

For those earning less, increasing the “Needs” portion can relieve stress, while saving even 10% builds the habit over time. The key is flexibility, not force-fitting.

For High Fixed Expenses

Living in a metro city or managing a large family might push your essential costs beyond 50%. If your rent or EMIs are high, consider a 60-20-20 split:

- 60% Needs

- 20% Wants

- 20% Savings/Debt

You still maintain balance, but with more breathing room for your responsibilities.

Custom Variants That Work

Over time, people have adapted the 50-30-20 rule into variants like:

- 70-20-10 – For aggressive savers who want to live minimally and invest more.

- 60-30-10 – For those with stable jobs but higher lifestyle or family costs.

- 40-30-30 – For dual-income households focusing on long-term wealth.

There’s no perfect formula—only what works for you. Smart budgeting for everyone means learning to listen to your numbers and adjusting accordingly, without guilt. Keep your goals in sight and modify the rule as life changes.

50-30-20 Rule vs Other Budgeting Methods

The 50-30-20 rule is popular for a reason—it’s simple, flexible, and beginner-friendly. But it’s not the only way to manage your money. Depending on your lifestyle, income flow, or financial mindset, other budgeting methods might suit you better. Comparing these options helps you find what truly supports smart budgeting for everyone.

1. Envelope System

This old-school method involves dividing your monthly cash into physical envelopes labeled with categories like groceries, rent, entertainment, etc. Once an envelope is empty, you stop spending in that area. It’s great for people who struggle with self-control and want a visual, hands-on way to track spending.

Pros:

- Highly visual and disciplined

- Limits overspending

- No tech required

Cons:

- Inconvenient in a cashless economy

- Hard to manage online payments or recurring expenses

50-30-20 Comparison:

Less flexible but more strict than the 50-30-20 rule. Ideal for cash-budgeters or beginners trying to control impulsive spending.

2. Zero-Based Budgeting

In this method, every rupee of your income is assigned a job—right down to zero. Your income minus expenses (including savings and debt payments) equals zero. Nothing is left “unplanned.” It forces you to account for every detail.

Pros:

- Great for detailed planners

- Maximizes control and awareness

- Works well for fixed incomes

Cons:

- Time-consuming

- Can feel overwhelming for beginners

50-30-20 Comparison:

While 50-30-20 gives a general direction, zero-based budgeting is more granular. Choose this if you want deeper control.

3. Priority-Based Budgeting

This flexible approach starts with your financial goals (e.g., debt freedom, home buying, saving for a trip) and builds a budget around them. Instead of fixed percentages, it focuses on what matters most.

Pros:

- Goal-driven and adaptable

- Works well for irregular incomes

- Encourages intentional spending

Cons:

- Needs personal discipline

- Less structured

50-30-20 Comparison:

More personalized and fluid. Ideal for people with changing goals or variable incomes.

In summary, smart budgeting for everyone doesn’t mean using one fixed method—it means choosing the one that aligns best with your lifestyle. The 50-30-20 rule is a great starting point, but exploring other systems can lead to even better results.

Tips to Stick to Your Budget

Creating a budget is the easy part—sticking to it consistently is where most people struggle. Even the best budgeting method won’t work unless it becomes a habit. That’s why building small, repeatable routines is essential for smart budgeting for everyone. Here are three simple yet powerful tips to help you stay on track.

1. Automate Your Savings

Treat savings like a fixed monthly expense, not an afterthought. Set up automatic transfers to your savings account, SIP, or emergency fund right after you receive your salary. When saving becomes automatic, you eliminate the temptation to spend that money elsewhere. It also helps you reach your financial goals faster, without constant effort.

2. Review Monthly

Life changes, and so do expenses. Make it a habit to review your budget every month—ideally at the start or end of the month. Look at where your money went, which category exceeded its limit, and what adjustments are needed for the next cycle. A quick 15-minute review keeps your finances aligned with reality and helps avoid surprises later.

3. Track Your Spending

You can’t control what you don’t track. Use budgeting apps, Google Sheets, or even a simple notebook to note down your daily or weekly expenses. This small step increases awareness and often leads to better decisions. Many people are shocked to see how much they spend on little things like food delivery or subscriptions. Tracking exposes those hidden leaks.

By following these three tips consistently, budgeting becomes less of a chore and more of a lifestyle. Remember, smart budgeting for everyone isn’t about being perfect—it’s about being mindful, proactive, and adaptable. Small efforts, repeated regularly, lead to big results.

Conclusion: Start Your Smart Budgeting Journey Today

Budgeting doesn’t have to be complicated. The 50-30-20 rule proves that managing your money can be simple, structured, and stress-free. By dividing your income into Needs (50%), Wants (30%), and Savings & Debt Repayment (20%), you create a clear path toward financial stability without sacrificing the things you enjoy. It’s a balanced approach that supports both your present lifestyle and future goals.

What makes this rule so effective is its flexibility—it adapts to your income, lifestyle, and priorities. Whether you’re a student, a salaried professional, or a freelancer, this method fits right in and gives you control over your finances without overwhelming you.

Remember, the goal isn’t perfection—it’s progress. Even small changes in how you spend and save can make a big difference over time. With the right mindset and a few helpful tools, smart budgeting for everyone becomes not just possible, but practical.

So, don’t wait for the “right time” to start. Your best time is today. Set up your first budget, track your expenses, and take the first step toward a financially secure future.

Also Read: 50 Most Useful Keyboard Shortcuts Everyone Should Know

FAQs: 50-30-20 Rule & Smart Budgeting

1. Is the 50-30-20 rule suitable for everyone?

Yes, it’s a great starting point for most people, especially beginners. However, depending on your income, location, or financial responsibilities, you may need to adjust the percentages slightly to suit your lifestyle.

2. Can I follow this rule on a low income?

Absolutely. Even if you earn less, the core idea of dividing your income into needs, wants, and savings still applies. You can start small, focus more on essentials, and gradually increase your savings as your income grows.

3. Is EMI considered a need or a want?

It depends on the nature of the EMI. Home loan or education loan EMIs are typically needs, while EMIs for gadgets or vacations usually fall under wants. Classifying correctly is key to smart budgeting for everyone.

4. How often should I revise my budget?

Ideally, review it once a month. Life changes—income increases, expenses shift, and new goals emerge. A monthly check-in ensures your budget always reflects your current reality.

5. Can I switch from 50-30-20 to another budgeting method later?

Yes, of course. The 50-30-20 rule is flexible and meant to help you get started. As you get more comfortable with budgeting, you can explore methods like zero-based budgeting or priority-based budgeting if they suit you better.

6. What if my needs go above 50%?

It happens, especially in high-cost cities or during certain life phases. In such cases, reduce your “wants” category or temporarily lower savings—just be sure to adjust intentionally, not emotionally.